The Ultimate Guide To Hard Money Atlanta

Wiki Article

8 Simple Techniques For Hard Money Atlanta

Table of ContentsWhat Does Hard Money Atlanta Do?Hard Money Atlanta Things To Know Before You Get ThisNot known Details About Hard Money Atlanta The smart Trick of Hard Money Atlanta That Nobody is Discussing

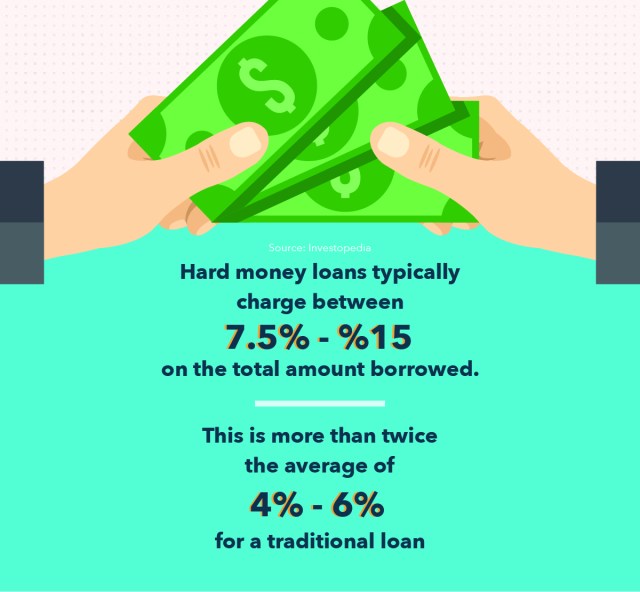

By contrast, rates of interest on hard cash lendings start at 6. 25% yet can go much higher based on your area and also the home's LTV. There are other prices to remember, as well. Tough money lending institutions often charge factors on your finance, occasionally referred to as origination charges. The factors cover the administrative prices of the lending.

Factors are generally 2% to 3% of the finance quantity. As an example, three factors on a $200,000 loan would be 3%, or $6,000. You may have to pay even more points if your car loan has a higher LTV or if there are several brokers associated with the transaction. Although some lending institutions bill only factors and no various other charges, others have additional costs such as underwriting charges.

The Single Strategy To Use For Hard Money Atlanta

You can expect to pay anywhere from $500 to $2,500 in underwriting fees. Some tough cash loan providers also bill prepayment fines, as they make their cash off the rate of interest charges you pay them. That indicates if you repay the finance early, you might have to pay an added cost, including to the finance's expense.This suggests you're much more most likely to be supplied funding than if you requested a traditional home mortgage with a questionable or slim credit rating. hard money atlanta. If you require cash swiftly for remodellings to turn a home commercial, a hard cash lending can offer you the cash you require without the trouble and also documents of a traditional mortgage.

It's a method capitalists utilize to get investments such as rental residential properties without using a whole lot of their very own properties, as well as difficult money can be useful in these situations. Although tough cash finances can be helpful for actual estate investors, they should be used with care especially if you're a novice to property investing.

With shorter payment terms, your regular monthly repayments will be much more pricey than with a routine home loan. If you skip on your car loan repayments with a difficult money lending institution, the consequences can be severe. Some car loans are personally assured so it can harm your credit report. And also since the finance is protected by the residential property in concern, the loan provider can occupy and also seize on the residential or commercial property due to the fact that it functions as security.

An Unbiased View of Hard Money Atlanta

To locate a trustworthy lending institution, talk to relied look at this now on realty agents or home loan brokers. They might have the ability to refer you to lenders they've worked with in the past. Difficult money lending institutions also typically participate in actual estate financier meetings so that can be a great location to get in touch with lenders his response near you. hard money atlanta.Equity is the value of the residential property minus what you still owe on the home loan. The underwriting for house equity finances likewise takes your credit scores history and also income right into account so they tend to have reduced rate of interest rates and also longer payment periods.

When it involves moneying their following offer, investor as well as entrepreneurs are privy to a number of offering choices practically created actual estate. Each includes certain demands to access, and also if made use of appropriately, can be of significant benefit to financiers. Among these loaning types is hard cash loaning. hard money atlanta.

It can also be called an asset-based financing or a STABBL car loan (temporary asset-backed bridge car loan) or a bridge finance. These are acquired from its characteristic short-term nature as well as the demand for concrete, physical security, generally in the type of actual estate residential or commercial property.

Hard Money Atlanta Things To Know Before You Get This

They are considered as temporary bridge financings and also the major use case for difficult money fundings is in property purchases. They are considered a "tough" cash finance due to the physical possession the genuine estate building needed to secure the finance. In case a debtor defaults on the car loan, the lender gets the go right to think possession of the residential property in order to recuperate the lending amount.As an outcome, requirements may differ substantially from loan provider to lending institution. If you are seeking a loan for the very first time, the approval process could be reasonably strict and also you may be required to offer extra details.

This is why they are primarily accessed by realty entrepreneurs who would commonly require fast funding in order to not miss out on warm chances. Additionally, the lending institution primarily considers the worth of the possession or home to be purchased instead of the consumer's individual money history such as debt score or income.

A traditional or small business loan might take up to 45 days to close while a hard money lending can be enclosed 7 to 10 days, in some cases quicker. The benefit as well as speed that tough cash lendings provide remain a major driving pressure for why investor pick to utilize them.

Report this wiki page